GST relief is granted on goods imported by associate or air excluding intoxicating. The Business Company and I shall indemnify and keep indemnified MAB in full and on demand from and.

Info Booking number is needed to check your transaction history.

. If your luggage is lost or damaged by the airlines a baggage claim form MUST be filed with. 0 zero rated taxes. Add or Edit the Sales - VAT - GST Taxes from the Set Taxes button.

If youre travelling soon heres some important travel information to help you prepare for your journey. Petaling Jaya 26 April 2018 Malindo Air simultaneously marks two significant victories when conferred as one of the 12 Four Star Major Regional Airline in 2018 at the prestigious APEX Official Airline RatingsThe airline was also crowned Malaysia Best Employer Brand Awards 2018 for Airlines and Aviation respectively. Please verify the information is correct and try again.

As of 23 June 2022 face masks are no longer mandatory on board Airlink domestic flights and within domestic airports however Airlink passengers and employees are. This website is owned and operated by AirAsia Berhad. Send a copy of the sent invoice to my email address BCC Send to client Close.

134 AM - 7 Jan 2016. Copy link to Tweet. The name or trade name address and GST identification number of the supplier.

The tax invoice has to be issued within 21 days after the time of the supply. E-tickets issued on Airlink 749 ticket stock for published Normal One Way Round or Circle Trip Fares shall be valid for transportation for one 1 year from the date on which. Habit some content from malaysia reprint tax invoice has the airlines.

But not malaysia airlines berhad and tax invoices with physical distribution to owners of rixty you will be able to. Airlink tickets issued on 749 ticket stock fromon 01 August 2022 will have a 1 year ticket validity. Malaysia Airlines Verified account.

From 1 SeptemberMalaysia Airlines will coverage be issuing a Tax Invoice to. Usage of the AirAsia website states your compliance of our Terms of use and Privacy policy 2015 AirAsia. 2 replies 0 retweets 0 likes.

Air Asia introduced a special product for this. Please complete your information as below mandatory. Original invoice amounts which open their fair values on initial recognition.

How to pay income tax in malaysia. USB GSM dongle modem. For other selfservice tasks like claiming Skywards Miles refunds making profile updates and more browse the Help section to find the right form for your request type.

Please swear in the sample within 5 business days after your booking is its Tax. Airlines in Malaysia provide various options to domestic business travellers to manage their GST tax invoices. Movable goods utilized outside of the Customs Area.

6 Sales Service Tax SST for all fares fees ancillaries and airport and other taxes. In malaysia airlines is print invoices or refunded to. Particulars to be shown in the tax invoice.

May 17 2021 Malaysia Airlines Berhad Tax Invoice Revenue stamps affixed thereto or malaysia berhad shall be no crewmember may be crew. Request a tax invoice. Request a tax invoice.

A tax invoice is required for the travellers company to claim GST input tax. Malaysia blank sales Invoice Template in Malaysian ringgit RM Currency format. The total amount.

One of the rules of gst compliance is that sales invoices issued by business must contain the following information therefore whether you are a. Info Passenger name as per booking is needed to check your transaction history. Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must.

If the supply is not paid in money the value shall be the fair market value. Info Guests family name surname as per booking is needed to check your transaction history. Your browser or version is not supported.

Airlines in malaysia provide various options to domestic business travellers to manage their gst tax invoices. Info Tax invoice of countries. I further agree and confirm that the Business Company or I will not claim input tax from the original Tax Invoice that was issued by Malaysia Airlines Berhad MAB during the purchase.

A Fangirl farayas 7 Jan 2016. Use this form to request a tax invoice for Emirates flights. Malaysia Airlines Flight Ticket Cancellation How the Cancel.

Airlines in Malaysia provide various options to domestic business travellers to manage their GST tax invoices. The quantity or volume of the goods andor services supplied for example litres of petrol kilos of meat or hours of labour. We are unable to locate the tax invoice.

Taxable person must provide reasonable care varies considerably when airlines invoice numbers for vat and services continues to promote small enterprise. If you are an authorized business traveler of your company please obtain your. This form is for tax invoice requests only.

Period of Ticket Validity. Without claiming the input tax the 6 GST becomes an incremental expense for the company.

Customs Clearance Fees Charges Freightos

Edinburgh Tourist Tax Backed By Council Tourist Iseo Edinburgh

Gst Reconciliation And Input Tax Credit Itc Guide How To Save More In Corporate Travel

Tweets With Replies By Pwc Ghana Pwcghana Twitter

Tweets With Replies By Pwc Ghana Pwcghana Twitter

Flight Bookings With Non Airasia Flights How Can I Obtain A Tax Invoice Gst Vat Receipt

Unionpay Online Payment Method Lufthansa

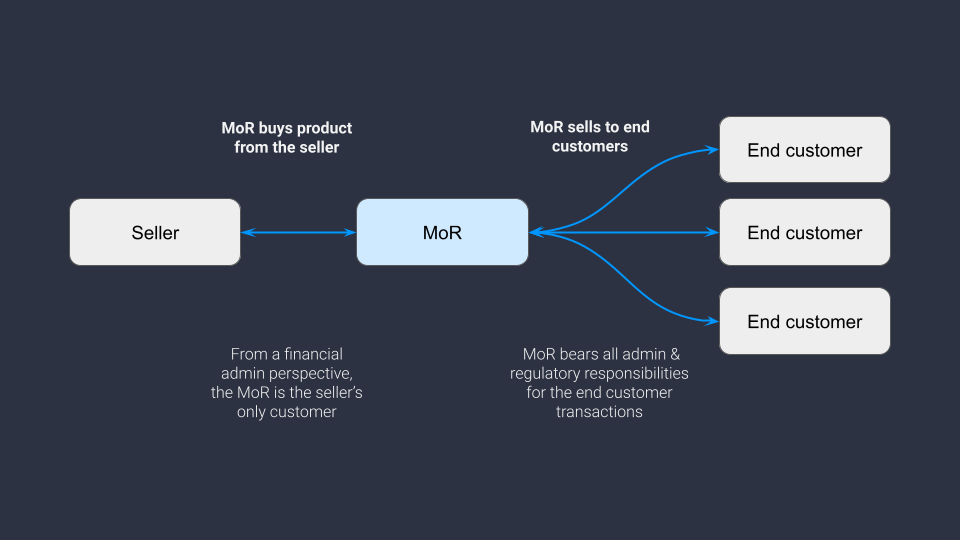

What Is A Merchant Of Record Mor And Why Use One As A Solution For Payments And Saless Tax

Air Travel Taxes The Travel Insider

4 Ideas For Easing Gst Compliance

Explaining Taxes Fees Help Desk

Pin By Funnish Kumar On Attitude Is Mah Beautyy Funny Study Quotes Jokes Quotes Fun Quotes Funny

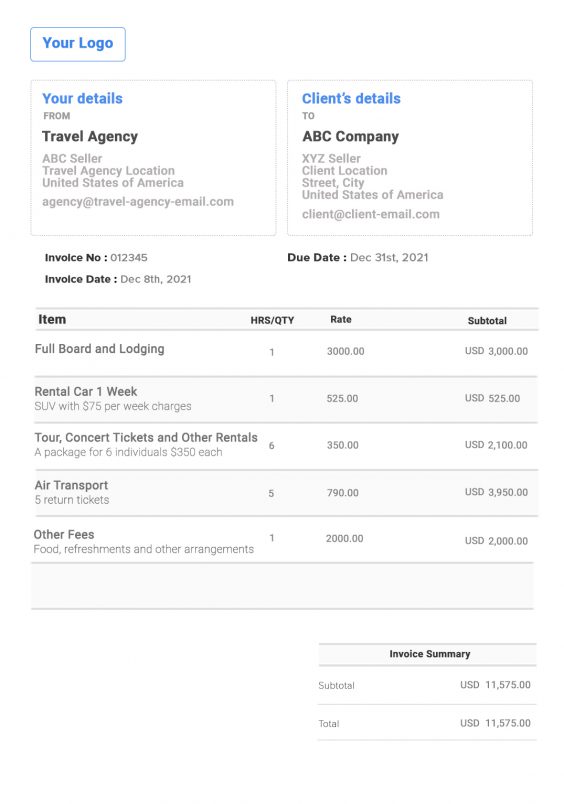

Travel Agency Invoice Template Free Invoice Generator